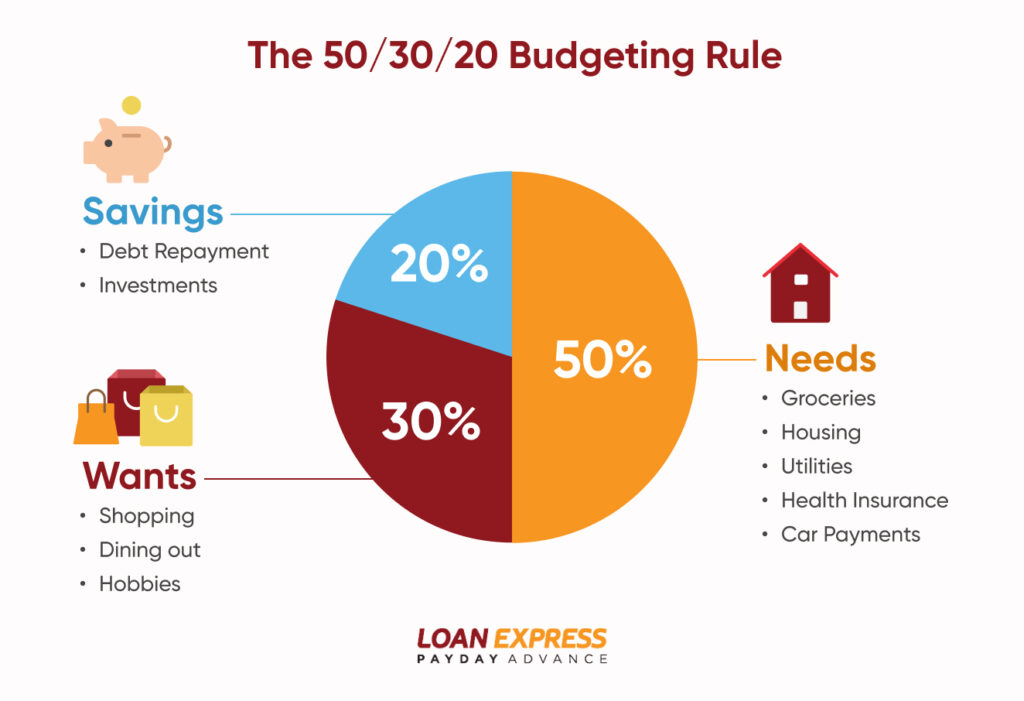

Managing money feels daunting for beginners, but simple budgeting tips for beginners can transform chaos into control. These strategies help track expenses, save for goals, and build financial security. Evergreen advice like the 50/30/20 rule 50% needs, 30% wants, 20% savings remains timeless, backed by financial experts for debt reduction and wealth building.

Why Budgeting is Essential for Financial Beginners

Budgets prevent overspending, curb impulse buys, and prepare for emergencies. Data from Ramsey Solutions shows budgeted households save 15-20% more annually. It’s empowerment: shift from reactive to proactive money management.

Step-by-Step Guide to Creating Your First Monthly Budget

Step 1: Calculate Your Income

List all sources: salary, freelancing. Use net income post-taxes. Tools like Excel or apps (Mint, YNAB) automate this.

Step 2: Track Expenses for One Month

Categorize: fixed (rent, utilities), variable (groceries, entertainment). Review bank statements awareness reveals leaks like daily coffee ($100/month?).

Step 3: Set Spending Limits with 50/30/20

Allocate percentages. Example: $3,000 income = $1,500 needs, $900 wants, $600 savings/debt.

Step 4: Prioritize Savings and Emergency Fund

Automate 10-20% transfers first. Aim for 3-6 months’ expenses in a high-yield account.

Step 5: Review and Adjust Weekly

Life changes tweak as needed. Weekly check-ins keep you accountable.

Top Simple Budgeting Tips for Beginners

- Zero-Based Budgeting: Assign every dollar a job until zero remains.

- Envelope System: Cash for categories like dining out prevents overspend.

- No-Spend Challenges: One week/month debt-free spending builds discipline.

- Cut Subscriptions: Audit Netflix, gym—save $50-200 easily.

- Meal Prep: Reduces eating out by 50%, saving hundreds.

Tools and Apps for Effortless Budget Tracking

Free: Google Sheets templates. Paid: PocketGuard auto-categorizes. Excel pros use formulas for projections.

Overcoming Common Budgeting Challenges

Emotional spending? Wait 48 hours. Irregular income? Average last 3 months. Partner buy-in? Joint apps foster teamwork.

Long-Term Financial Goals with Monthly Budgets

Short-term: vacation fund. Long-term: retirement via 401(k). Consistent budgeting compounds: $200/month at 7% return = $500K in 40 years.

Master these simple budgeting tips for beginners, and financial freedom awaits. Start small, stay consistent—your future self thanks you.